Table of Contents

ToggleAbout Mann Mortgage

Mann Mortgage is an American family-owned organization emphasizing community relationships, honesty, and integrity.

Mann Mortgage provides loans for any size project, large and small. Also, they help qualified borrowers with building new apartments, repairs, alterations, upgrading the property landscape, or replacing roofs.

Mann is run by professionals who empathize with their customers and claim a policy of total client satisfaction. On the other hand, Mann Mortgage offers a wide selection of loans from which to choose, including Federal Housing Administration (FHA), Veterans Administration (VA), jumbo, non-conforming, conventional, USDA rural development (RD), refinancing, and fixed-rate and adjustable-rate mortgages (ARM).

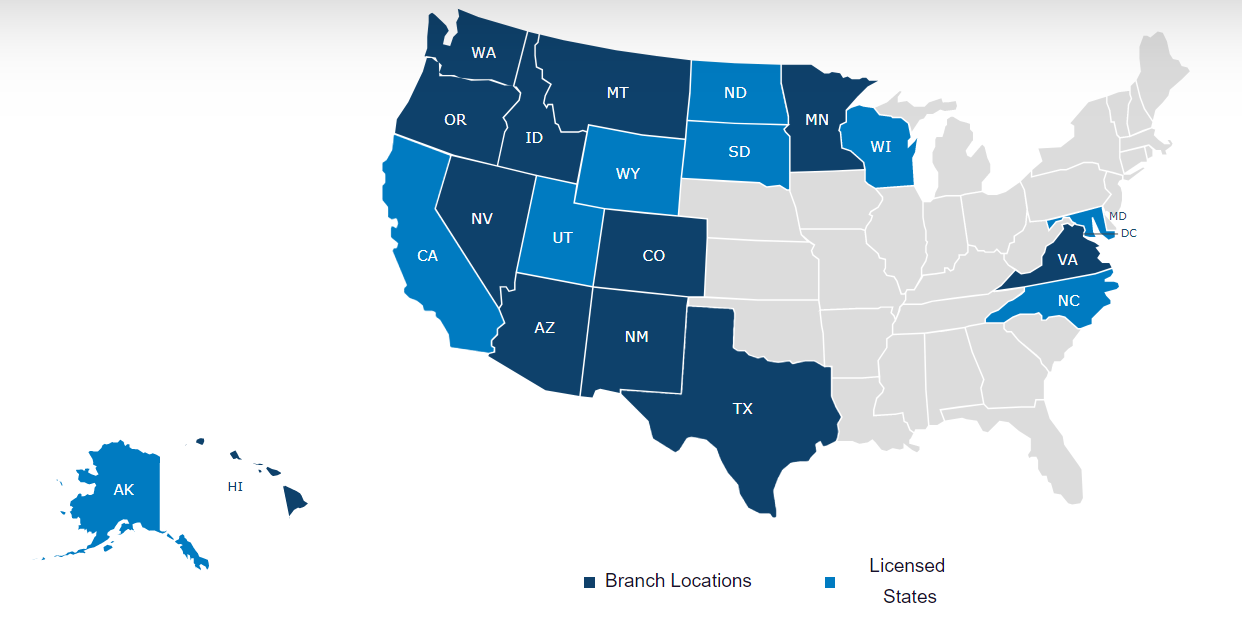

For over 30 years, Mann Mortgage has proven its dedication to the community and is now licensed in 22 states, with branches operating all over the United States.

Online Mann Mortgage Reviews

Although not accredited by it, Mann Mortgage boasts an A+ rating from the Better Business Bureau (BBB) and positive customer ratings on Yelp, Facebook, and Zillow. Mann Mortgage also has thousands of positive reviews on its website and third-party survey platforms.

Contact Mann Mortgage

Obtaining a loan from Mann Mortgage is as seamless as possible, which is vital in home financial emergencies. When you complete an online application form, they will contact you. Headquartered in Montana, Mann Mortgage also has a customer care team available 24/7 for inquiries via phone or email.

Loan Options and Rates

Mann provides financing services to real estate investors and individual borrowers, with varying fees in different states nationwide. Further, terms are available for up to 30 years on all eligible condos, 1 to 4-unit apartments, and planned unit developments (PUD).

How Long Does It Take?

Mann Mortgage typically takes up to 15 days to process a loan depending on the amount requested and repayment methods. Moreover, Mann Mortgage charges a mortgage insurance lender fee of about 1% based on loan-to-value (LTV). Other loan rates, like after-repair value (ARV) and interest rates, vary depending on the loan program and your residential region.

As a first-time homebuyer, you will be assisted with choosing the right program to enroll in.

Mann offers competitive home-lending services tailored to your needs, as outlined below:

- Purchases & Refinances

- Conforming Loans

- Jumbo Loans

- FHA, VA, USDA & First-Time Homebuyer Programs

- Primary Residences, Second Homes & Investment Property

- Construction Loans

- Montana Board of Housing Loans

- Down-Payment Assistance

- Fixed-Rate or Adjustable-Rate Reverse Mortgage/Home Equity Conversion Mortgage (HECM) Loans

Loan Application Process

To successfully obtain a loan, you should first have a good FICO score and all the relevant documents to establish your credit situation. Secondly, the loan officer will review your assets and financial standing to establish your credibility in repaying the loan being applied for.

Mann Mortgage has a simplified online loan application process that will take less than 10 minutes to complete. You will be required to provide your personal information, including any documentation on your real estate property assets and the loan you are applying for.

Finally, submit your application upon completion, and a customer care representative will contact you. The loan may take up to 2 weeks to process, depending on the loan type and amount.

Conclusion

Pros of Mann Mortgage

- The simple online loan application process

- Numerous loan options, including VA, FHA, and USDA loans

- Less than two weeks to process a loan

- Reliable customer care and feedback services

- Operating license in numerous states all over the United States

Cons of Mann Mortgage

- Not accredited by the Better Business Bureau, although it has offered reliable services to many satisfied customers.

Mann Mortgage has exceptional customer service delivery and timelines. Offering a wide variety of financing services to approved customers, their flexibility ensures prompt and convenient access to the desired loan.

Compare Mortgage Providers

Mortgages are a big deal. As good practice, you should compare mortgage providers to ensure that you select a partner that is in line with your values and with which you feel comfortable handling your mortgage.